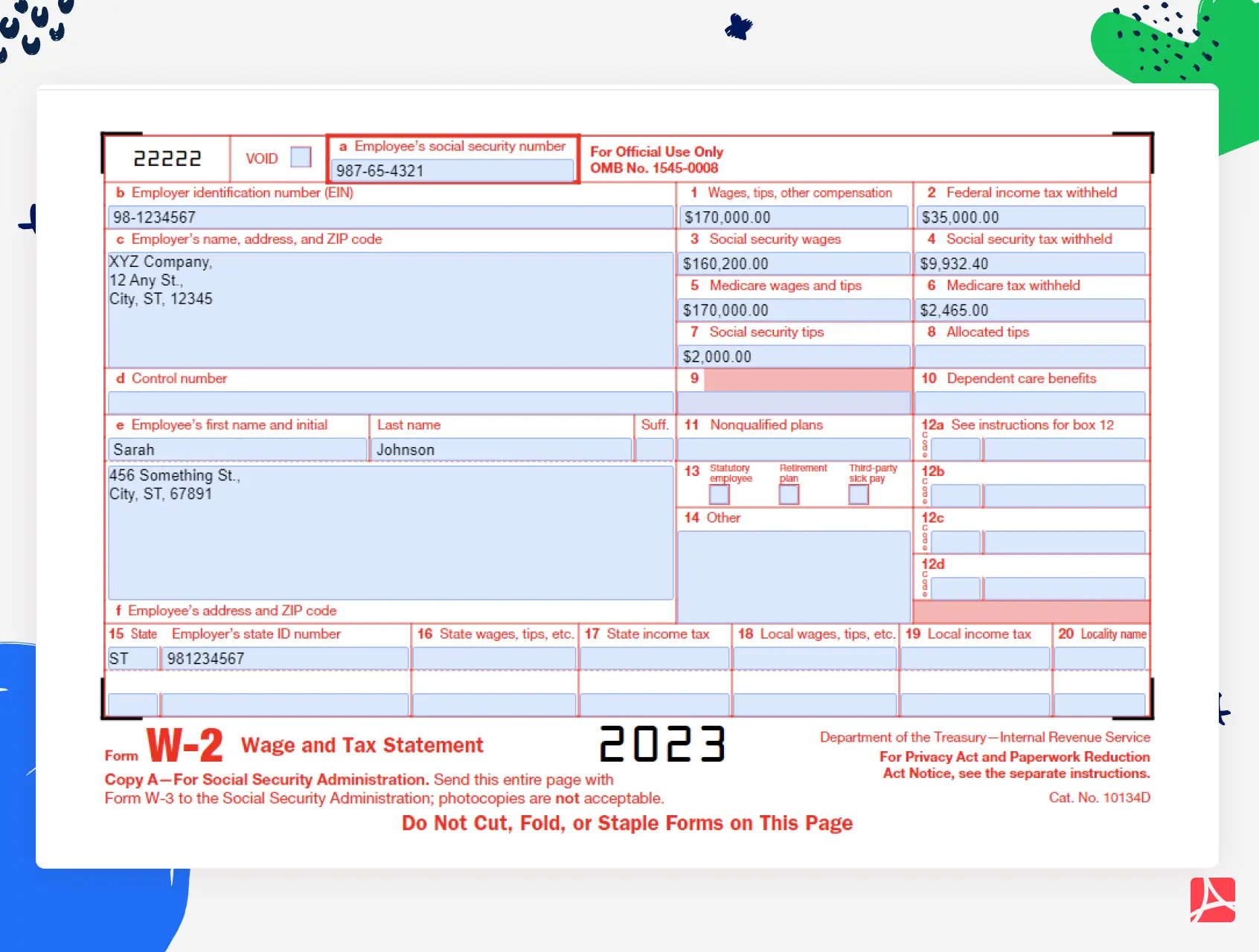

Sample Of W-2

The W-2 form, officially known as the Wage and Tax Statement, is a crucial document that employers must provide to their employees and the Internal Revenue Service (IRS) by the end of January each year. This form details the employee's income and the taxes withheld from their paycheck over the previous tax year. Understanding the components of a W-2 is essential for both employers and employees to ensure compliance with tax laws and to facilitate the filing of individual tax returns.

Components of a W-2 Form

A standard W-2 form includes several key pieces of information that are vital for tax reporting purposes. These components can be broken down into several sections, including employer information, employee information, and tax withholding details. The form is divided into boxes, each designated for specific data. For instance, Box 1 reports the employee’s wages, tips, and other compensation, while Box 2 details the federal income tax withheld. Other boxes provide information on social security wages, social security tax withheld, Medicare wages and tips, and Medicare tax withheld, among other details.

Understanding W-2 Boxes

Each box on the W-2 form serves a specific purpose and is used to report different types of income and taxes. For example, Box 3 and Box 5 are used to report social security and Medicare wages, respectively, ensuring that these amounts do not exceed the maximum taxable amounts for social security. Box 12 is particularly notable as it reports various types of compensation and benefits, such as code D for elective deferrals to a 401(k) plan or code BB for designated Roth contributions under a section 401(k) plan. Understanding these codes and the information they convey is crucial for accurately reporting income and claiming deductions on an individual’s tax return.

| Box Number | Description |

|---|---|

| Box 1 | Wages, tips, other compensation |

| Box 2 | Federal income tax withheld |

| Box 3 | Social Security wages |

| Box 4 | Social Security tax withheld |

| Box 5 | Medicare wages and tips |

| Box 6 | Medicare tax withheld |

| Box 12 | Codes for various types of compensation and benefits |

Importance of Accurate W-2 Reporting

The accuracy of the information on a W-2 form is critical for both employers and employees. For employers, accurate reporting ensures compliance with tax laws and regulations, reducing the risk of penalties and fines. For employees, correct W-2 information is necessary for filing accurate tax returns, claiming the right amount of deductions, and receiving the appropriate refund. Inaccurate or missing W-2 forms can lead to delays in processing tax returns, potentially resulting in late filing penalties and interest on owed taxes.

What to Do if a W-2 is Incorrect or Missing

If an employee discovers an error on their W-2 or does not receive a W-2, they should contact their employer immediately. The employer is responsible for correcting any errors and issuing a revised W-2, known as a W-2c. If the issue cannot be resolved with the employer, or if the employer is no longer in business, employees may need to contact the IRS for assistance. The IRS can help resolve the issue by contacting the employer on the employee’s behalf or by providing instructions on how to file tax returns without a W-2, using Form 4852, Substitute for Form W-2, Wage and Tax Statement.

What should I do if I don't receive my W-2 by the end of January?

+If you don't receive your W-2 by the end of January, contact your employer to request that they send you a copy. If you are unable to get a copy from your employer, you may need to contact the IRS for assistance. They can help you get a replacement W-2 or guide you through the process of filing your tax return without one.

Can I file my tax return without a W-2?

+In conclusion, the W-2 form is a vital document for tax reporting purposes, providing a summary of an employee’s income and taxes withheld. Understanding the components of a W-2 and ensuring its accuracy are crucial for compliance with tax laws and for facilitating the filing of individual tax returns. Employees should review their W-2 forms carefully, address any discrepancies promptly, and seek assistance if they encounter issues with receiving or correcting their W-2.