What Is Florida State Sales Tax? Easy Exemption Guide

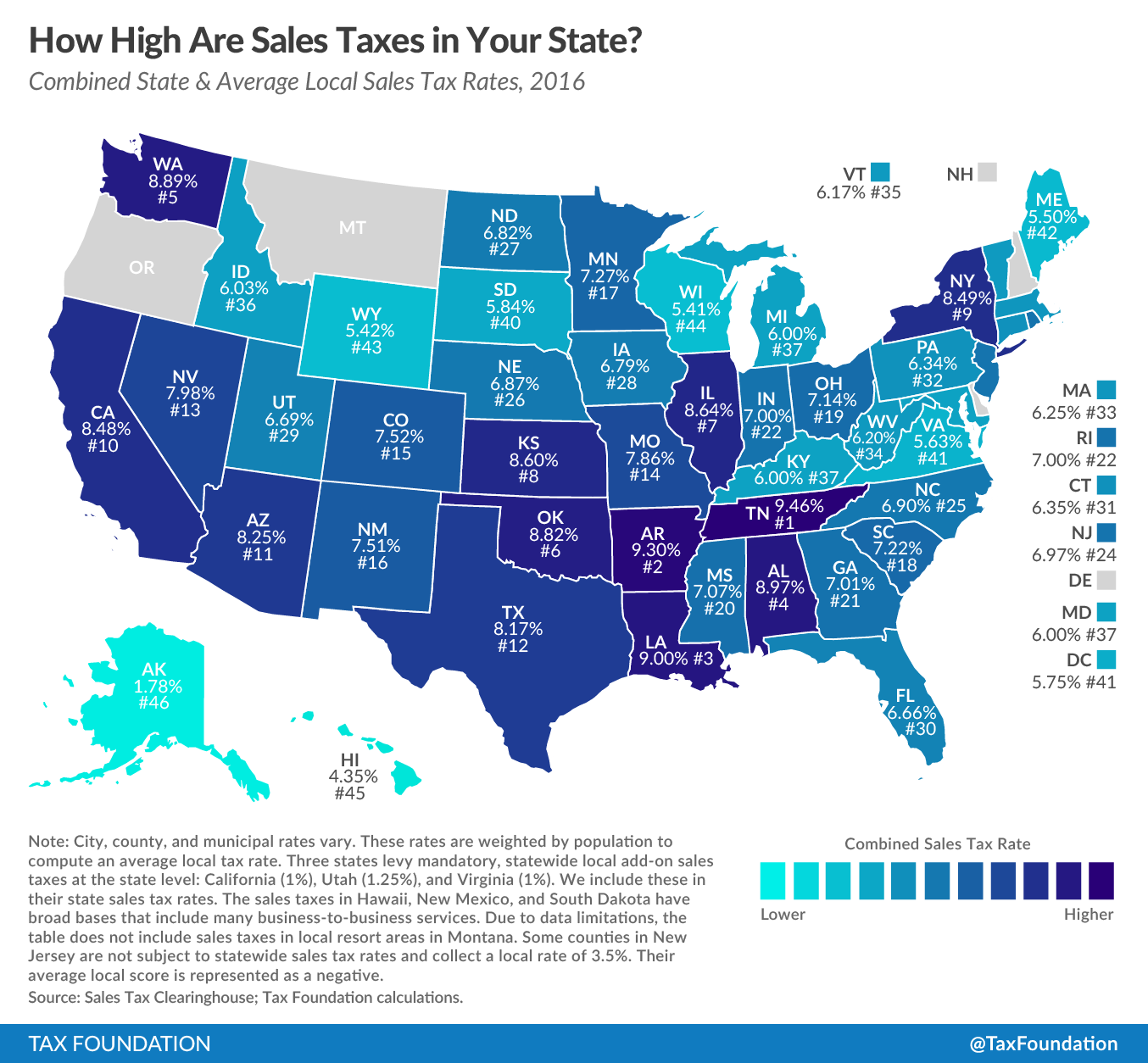

Florida state sales tax is a tax levied on the sale of tangible personal property and certain services within the state. The state sales tax rate in Florida is 6%, but this rate can vary depending on the location due to discretionary sales surtaxes imposed by local governments. Understanding Florida sales tax and how it applies to different transactions is crucial for businesses and consumers alike to ensure compliance with state tax laws and to take advantage of available exemptions.

Overview of Florida Sales Tax

Florida’s sales tax is administered by the Florida Department of Revenue. The tax applies to the sale of tangible personal property, which includes items such as clothing, furniture, and electronics, as well as to certain services like amusement park tickets and hotel stays. However, not all services are subject to sales tax; for example, medical services, insurance services, and educational services are typically exempt. It’s important to note that while the state rate is 6%, the total sales tax paid can range from 6% to 8% due to local surtaxes, which vary by county.

Discretionary Sales Surtax

The discretionary sales surtax, also known as local option sales tax, is imposed by counties and can range from 0.5% to 1.5%. This surtax is added to the state sales tax rate of 6%, resulting in a combined state and local sales tax rate that can vary significantly across different counties in Florida. For instance, some counties may have a total sales tax rate of 6.5% if they impose a 0.5% surtax, while others may have a rate of 7.5% with a 1.5% surtax.

| County | Local Surtax Rate | Total Sales Tax Rate |

|---|---|---|

| Broward County | 0.5% | 6.5% |

| Miami-Dade County | 1% | 7% |

| Orange County | 0.5% | 6.5% |

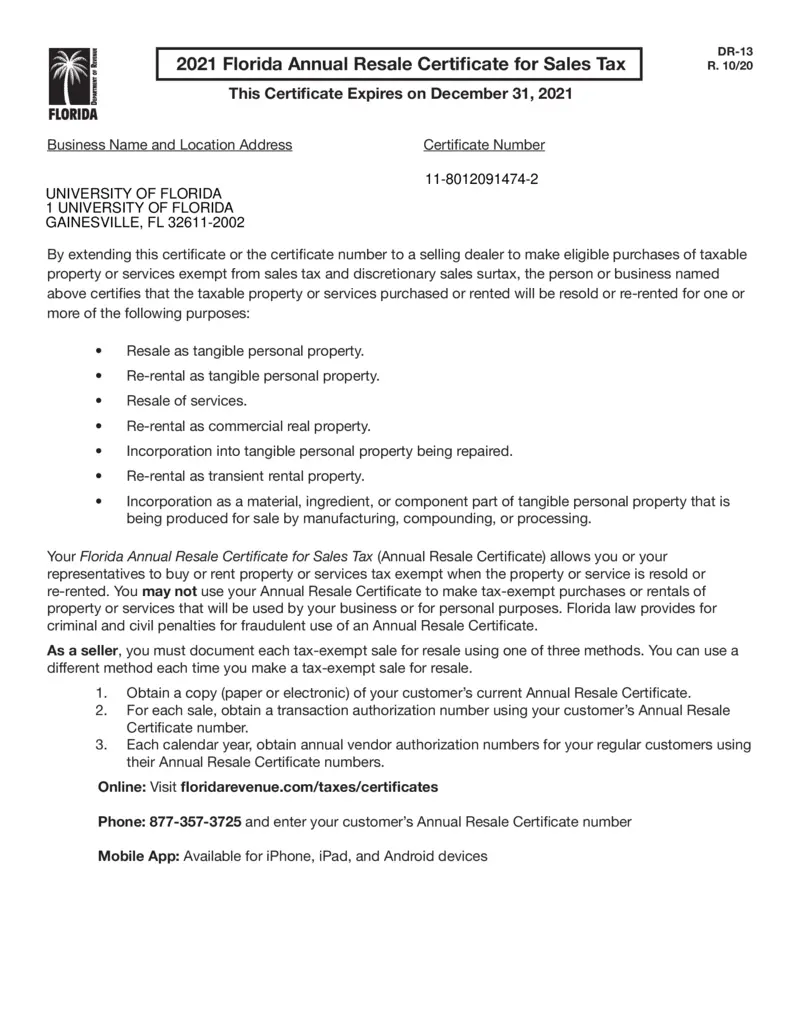

Exemptions from Florida Sales Tax

While sales tax applies to most tangible personal property and certain services, there are several exemptions. These exemptions can significantly reduce the tax liability for businesses and consumers who qualify. Common exemptions include sales of groceries, prescription medicines, and medical devices. Additionally, Florida offers exemptions for specific industries, such as the agricultural industry, where equipment and supplies used in farming are exempt from sales tax.

Exemption for Certain Items and Services

Certain items are exempt from sales tax to promote specific policy goals or to reduce the burden on low-income families. For example, the sale of diapers and incontinence products for humans is exempt from sales tax. Moreover, educational services provided by public schools and certain private schools are exempt, as well as tuition for higher education institutions.

- Prescription medicines and medical devices

- Groceries (with some exceptions for prepared foods)

- Farm equipment and supplies

- Diapers and incontinence products

- Education services by public and certain private schools

Easy Exemption Guide for Businesses

For businesses, navigating the complex landscape of sales tax exemptions can be challenging. However, there are steps that businesses can take to ensure they are in compliance and taking full advantage of available exemptions. First, businesses should review the Florida Department of Revenue’s guidelines on sales tax to understand which of their products or services are subject to tax. Second, they should implement a system to track sales and apply the correct sales tax rate based on the location of the sale. Finally, businesses should regularly review their operations to identify areas where exemptions may apply and consult with a tax professional if they are unsure about any aspect of sales tax compliance.

Steps for Compliance

Compliance with Florida sales tax laws requires ongoing effort. Businesses must register for a sales tax permit, collect and remit sales tax, and file sales tax returns on time. They must also keep accurate records of all sales, including those that are exempt from sales tax, to support their tax filings in case of an audit.

- Register for a sales tax permit with the Florida Department of Revenue

- Collect sales tax on taxable sales

- File sales tax returns and remit collected tax by the deadline

- Maintain accurate and detailed records of sales and tax collections

What is the current state sales tax rate in Florida?

+The current state sales tax rate in Florida is 6%. However, the total sales tax rate can range from 6% to 8% due to local discretionary sales surtaxes.

Are groceries exempt from sales tax in Florida?

+Yes, groceries are generally exempt from sales tax in Florida, with some exceptions for prepared foods.

How do I register for a sales tax permit in Florida?

+You can register for a sales tax permit through the Florida Department of Revenue's website or by contacting their office directly. You will need to provide business information and may need to pay a registration fee.

In conclusion, understanding and complying with Florida’s sales tax laws is essential for businesses and individuals to avoid unnecessary penalties and take advantage of available exemptions. By staying informed about the state sales tax rate, local surtaxes, and exemptions, individuals and businesses can navigate the complexities of sales tax in Florida effectively.