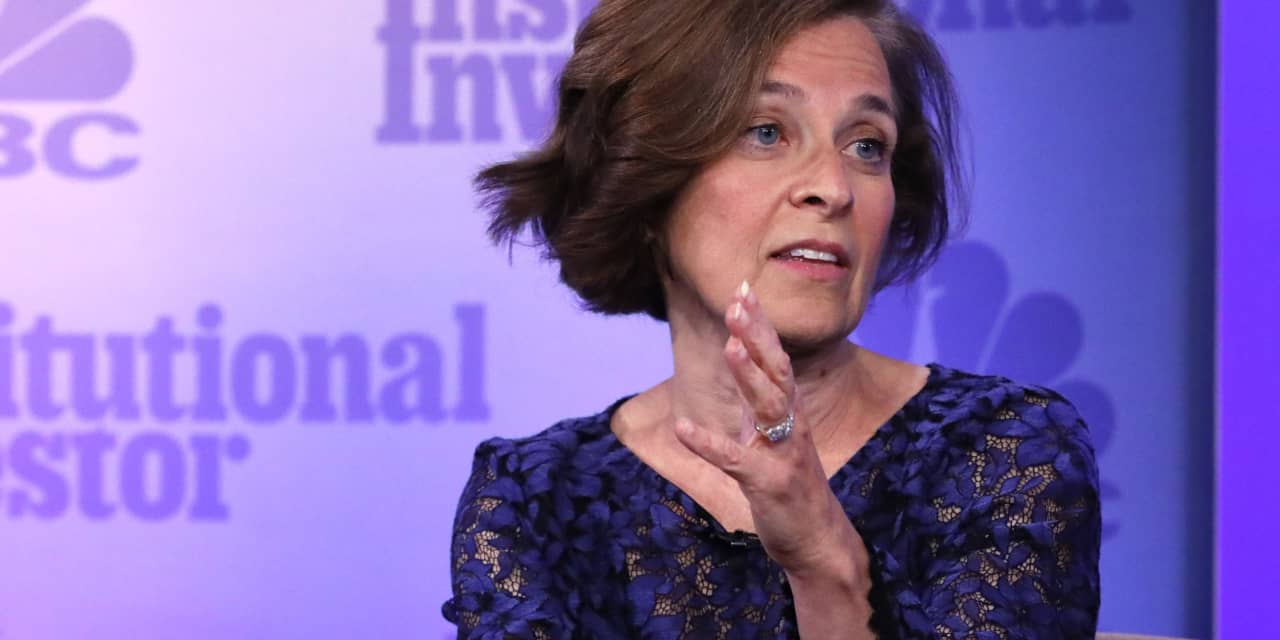

Sarah Bloom Raskin

Sarah Bloom Raskin is a prominent American lawyer and economist who has made significant contributions to the field of financial regulation and monetary policy. Born in 1961 in Ohio, Raskin earned her Bachelor's degree in economics from Amherst College and later received her Juris Doctor (J.D.) degree from Harvard Law School. Her educational background laid the foundation for her future roles in shaping the country's financial landscape.

Early Career and Regulatory Experience

Raskin’s professional journey began with her work as a law clerk for the U.S. Court of Appeals for the D.C. Circuit. She then transitioned into private practice, specializing in financial institutions and regulatory law. Her expertise in this area eventually led to her appointment as the Commissioner of Financial Regulation for the State of Maryland, a position she held from 2007 to 2010. During her tenure, Raskin played a crucial role in regulating the state’s financial institutions and overseeing the implementation of consumer protection laws.

Service on the Federal Reserve

In 2010, Raskin was nominated by President Barack Obama to serve as a member of the Federal Reserve Board of Governors. She was confirmed by the Senate and took office in October of that year. As a Governor, Raskin was instrumental in shaping the Fed’s monetary policy and regulatory approach, particularly in the aftermath of the 2008 financial crisis. Her term on the Federal Reserve Board lasted until 2014, during which time she was a strong advocate for stricter regulations on large financial institutions and greater transparency in monetary policy decision-making.

Some of Raskin's notable contributions during her time on the Federal Reserve include her support for the Dodd-Frank Wall Street Reform and Consumer Protection Act, a comprehensive regulatory overhaul aimed at preventing future financial crises. She also played a key role in the development of the Volcker Rule, a provision of the Dodd-Frank Act that restricts certain types of speculative trading by commercial banks.

| Position | Dates |

|---|---|

| Commissioner of Financial Regulation, Maryland | 2007-2010 |

| Member, Federal Reserve Board of Governors | 2010-2014 |

| Deputy Secretary, U.S. Department of the Treasury | 2014-2017 |

Later Career and Policy Impact

After leaving the Federal Reserve in 2014, Raskin was appointed as the Deputy Secretary of the U.S. Department of the Treasury, a position she held until 2017. In this role, she continued to shape U.S. financial policy, focusing on issues such as financial stability, regulatory reform, and consumer protection. Raskin has been a vocal advocate for stricter regulations on large financial institutions, arguing that such measures are essential for preventing future financial crises and protecting consumers.

Her work has also emphasized the importance of macroprudential policy, which involves using regulatory tools to mitigate systemic risks in the financial system. Raskin has argued that macroprudential policy is critical for maintaining financial stability, particularly in the context of a highly interconnected global financial system.

Current Activities and Influence

Today, Raskin continues to be an influential voice in the field of financial regulation and monetary policy. She has written extensively on these topics, publishing articles and op-eds in leading financial and economic journals. Raskin has also been a frequent speaker at conferences and seminars, sharing her insights with policymakers, academics, and industry professionals.

Some of her recent work has focused on the impact of climate change on financial stability, highlighting the need for financial regulators to incorporate climate-related risks into their oversight and supervision of financial institutions. Raskin has also emphasized the importance of financial inclusion, arguing that efforts to expand access to financial services can help reduce income inequality and promote economic growth.

What is Sarah Bloom Raskin's background in financial regulation?

+Raskin has extensive experience in financial regulation, having served as the Commissioner of Financial Regulation for the State of Maryland and as a member of the Federal Reserve Board of Governors. She has also worked in private practice, specializing in financial institutions and regulatory law.

What are some of Raskin's notable contributions to financial policy?

+Raskin has been a strong advocate for stricter regulations on large financial institutions, greater transparency in monetary policy decision-making, and the importance of macroprudential policy in maintaining financial stability. She has also emphasized the need for financial regulators to incorporate climate-related risks into their oversight and supervision of financial institutions.

In conclusion, Sarah Bloom Raskin is a highly respected expert in the field of financial regulation and monetary policy, with a deep understanding of the complex interplay between financial stability, consumer protection, and economic growth. Her contributions to U.S. financial policy have been significant, and her ongoing work continues to shape the debate on these critical issues.