H1b Filing Fees Explained

The H1B visa is a non-immigrant visa that allows U.S. employers to temporarily employ foreign workers in specialty occupations. The H1B filing process involves several steps, including filing a Labor Condition Application (LCA) with the U.S. Department of Labor, obtaining a certified LCA, and submitting a petition to U.S. Citizenship and Immigration Services (USCIS). One of the crucial aspects of the H1B filing process is the associated fees, which can be complex and vary depending on the type of petition and the size of the employer. In this article, we will delve into the H1B filing fees, explaining the different types of fees, who is responsible for paying them, and how they can impact the overall H1B filing process.

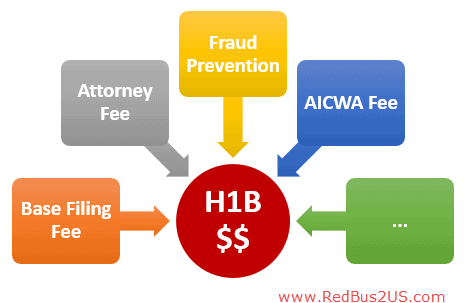

H1B Filing Fee Structure

The H1B filing fee structure consists of several components, including the base filing fee, the American Competitiveness and Workforce Improvement Act (ACWIA) fee, the Fraud Detection and Prevention fee, and the Premium Processing fee. The base filing fee is currently 460, which is paid by the employer to USCIS for processing the H1B petition. The ACWIA fee, also known as the training fee, ranges from 750 to 1,500, depending on the size of the employer. Employers with 25 or fewer full-time equivalent employees pay the lower fee, while those with 26 or more full-time equivalent employees pay the higher fee. The Fraud Detection and Prevention fee is 500, which is used to help detect and prevent immigration fraud. The Premium Processing fee is $1,410, which allows for expedited processing of the H1B petition within 15 calendar days.

Fee Breakdown

The following is a breakdown of the H1B filing fees:

| Fee Type | Fee Amount |

|---|---|

| Base Filing Fee | $460 |

| ACWIA Fee (25 or fewer employees) | $750 |

| ACWIA Fee (26 or more employees) | $1,500 |

| Fraud Detection and Prevention Fee | $500 |

| Premium Processing Fee | $1,410 |

It is essential to note that these fees are subject to change, and employers should always check the USCIS website for the most up-to-date information on H1B filing fees. Additionally, some employers may be exempt from paying certain fees, such as non-profit organizations or institutions of higher education.

Who Pays the Fees?

The employer is typically responsible for paying the H1B filing fees, including the base filing fee, the ACWIA fee, and the Fraud Detection and Prevention fee. However, the Premium Processing fee can be paid by either the employer or the employee, depending on the agreement between the two parties. It is essential for employers to clearly outline who is responsible for paying the fees in the employment contract or agreement.

Impact of H1B Filing Fees on Employers

The H1B filing fees can have a significant impact on employers, particularly small businesses or startups. The fees can be a substantial cost, and employers may need to factor them into their budget when hiring foreign workers. Additionally, the fees can be a barrier for some employers, particularly those with limited resources or those who are new to the H1B filing process. Employers should carefully consider the costs and benefits of hiring foreign workers and ensure that they have a clear understanding of the H1B filing fees and the overall petition process.

Strategies for Managing H1B Filing Fees

Employers can use several strategies to manage H1B filing fees, including:

- Budgeting for the fees: Employers should ensure that they have a clear understanding of the H1B filing fees and budget for them accordingly.

- Exempting certain fees: Employers may be exempt from paying certain fees, such as the ACWIA fee, if they are a non-profit organization or institution of higher education.

- Using Premium Processing: Employers can use Premium Processing to expedite the H1B petition process, which can help reduce the overall cost of the fees.

By understanding the H1B filing fees and using strategies to manage them, employers can ensure a smooth and successful petition process for their foreign workers.

What is the current base filing fee for an H1B petition?

+The current base filing fee for an H1B petition is $460.

Who is responsible for paying the H1B filing fees?

+The employer is typically responsible for paying the H1B filing fees, including the base filing fee, the ACWIA fee, and the Fraud Detection and Prevention fee. However, the Premium Processing fee can be paid by either the employer or the employee.

Can employers be exempt from paying certain H1B filing fees?

+Yes, certain employers may be exempt from paying certain H1B filing fees, such as non-profit organizations or institutions of higher education.

In conclusion, the H1B filing fees are an essential aspect of the H1B petition process, and employers must have a clear understanding of the fees and who is responsible for paying them. By using strategies to manage the fees and ensuring compliance with USCIS regulations, employers can ensure a successful petition process for their foreign workers.