Arizona Sales Tax

The state of Arizona imposes a sales tax on the retail sale of tangible personal property and certain services. The sales tax is administered by the Arizona Department of Revenue and is used to fund various state and local government programs. As of 2022, the state sales tax rate in Arizona is 5.6%, which is one of the lower rates in the United States. However, local governments in Arizona are also authorized to impose their own sales taxes, which can range from 0.5% to 3.5%. This means that the total sales tax rate in Arizona can vary significantly depending on the location.

State Sales Tax Rate

The state sales tax rate in Arizona is 5.6%, which applies to the retail sale of most tangible personal property and certain services. This includes items such as clothing, furniture, electronics, and vehicles, as well as services like restaurant meals and hotel stays. The state sales tax is imposed on the seller, but it is typically passed on to the buyer in the form of a higher price. The Arizona Department of Revenue collects the state sales tax and distributes the revenue to various state government programs, including education, healthcare, and public safety.

Local Sales Tax Rates

In addition to the state sales tax, local governments in Arizona are authorized to impose their own sales taxes. These local sales taxes can range from 0.5% to 3.5% and are imposed on the same types of transactions as the state sales tax. The local sales tax rates vary depending on the location, with cities and counties imposing their own rates. For example, the city of Phoenix imposes a local sales tax rate of 2.3%, while the city of Tucson imposes a rate of 2.1%. The local sales tax revenue is used to fund local government programs and services, such as police and fire protection, road maintenance, and parks and recreation.

| City/County | Local Sales Tax Rate |

|---|---|

| Phoenix | 2.3% |

| Tucson | 2.1% |

| Pima County | 1.5% |

| Maricopa County | 1.2% |

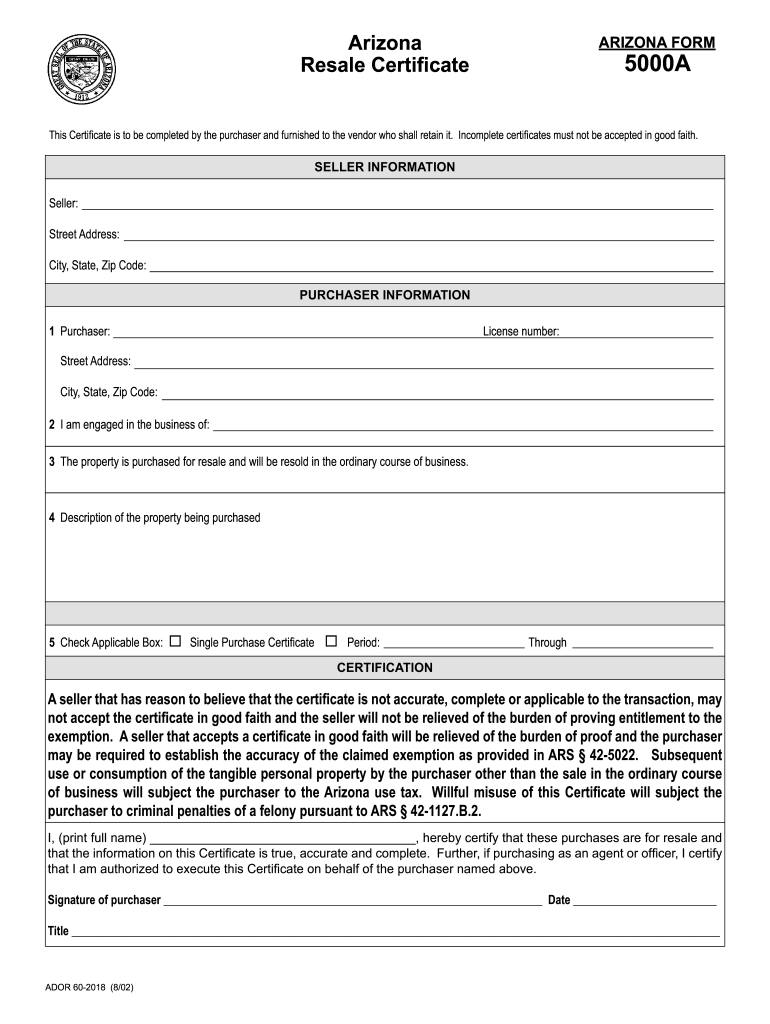

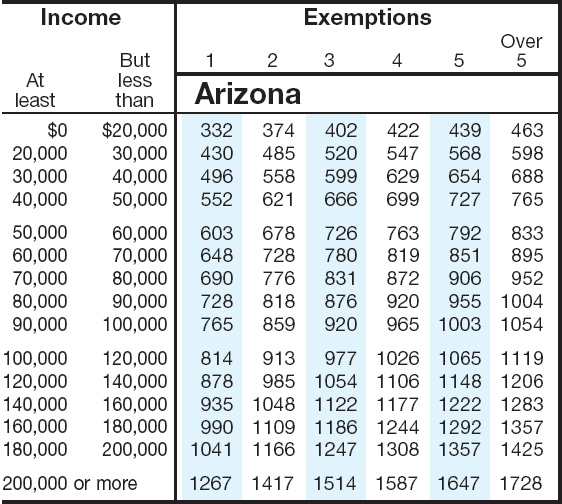

Exemptions and Deductions

Certain types of transactions are exempt from the Arizona sales tax, including sales of food for home consumption, prescription medications, and medical devices. Additionally, some businesses may be eligible for deductions or exemptions from the sales tax, such as manufacturers who purchase equipment or materials for use in their manufacturing processes. The Arizona Department of Revenue provides guidance on the specific exemptions and deductions available under the state sales tax law.

Food for Home Consumption

Sales of food for home consumption are exempt from the Arizona sales tax. This includes items such as groceries, meat, dairy products, and bakery goods. However, sales of prepared food, such as restaurant meals or take-out, are subject to the sales tax. It’s worth noting that some cities and counties in Arizona may impose their own sales taxes on food for home consumption, so the tax treatment can vary depending on the location.

- Exempt: groceries, meat, dairy products, bakery goods

- Taxable: restaurant meals, take-out, prepared food

What is the state sales tax rate in Arizona?

+The state sales tax rate in Arizona is 5.6%.

Do local governments in Arizona impose their own sales taxes?

+Yes, local governments in Arizona are authorized to impose their own sales taxes, which can range from 0.5% to 3.5%.

Compliance and Enforcement

The Arizona Department of Revenue is responsible for administering and enforcing the state sales tax law. Businesses that are required to collect and remit sales tax must register with the department and file regular returns. The department also conducts audits and investigations to ensure compliance with the sales tax law. Penalties and interest can be imposed on businesses that fail to comply with the law, so it’s essential for businesses to understand their sales tax obligations and take steps to ensure compliance.

Audits and Investigations

The Arizona Department of Revenue conducts regular audits and investigations to ensure compliance with the sales tax law. These audits can be conducted on a routine basis or in response to a complaint or tip. During an audit, the department will review the business’s sales tax returns, invoices, and other records to ensure that the business is collecting and remitting the correct amount of sales tax. If the department finds that a business has underpaid or failed to pay sales tax, it can impose penalties and interest on the business.

- Registration: businesses must register with the Arizona Department of Revenue

- Regular returns: businesses must file regular sales tax returns

- Audits and investigations: the department conducts audits and investigations to ensure compliance